In the ever-evolving universe of cryptocurrencies, anticipation surrounding new mining machines is akin to a digital gold rush. As Aleo, an innovative privacy-focused blockchain, prepares for its official launch, the spotlight intensifies on how to secure the best Aleo mining machine deals beforehand. For companies specializing in the sale and hosting of mining machines, understanding the nuances behind Aleo’s mining ecosystem, the hardware demands, and strategic acquisition approaches can spell the difference between capitalizing on early momentum and falling behind in a competitive market.

Mining machines, or mining rigs, form the backbone of any blockchain network’s security and transaction validation processes. With Bitcoin (BTC) and Ethereum (ETH) already dominating many mining conversations, the arrival of Aleo brings fresh criteria for mining rig enthusiasts and miners alike. Aleo employs zero-knowledge proofs to empower privacy, which demands specialized hardware optimized to handle cryptographic computations with efficiency. Unlike traditional GPU-dominant Ethereum mining rigs or the ASIC-centric Bitcoin mining miners, Aleo mining machines may blend unique technical requirements that challenge manufacturers and resellers to innovate swiftly.

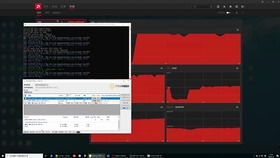

For mining farms—large-scale operations hosting hundreds or thousands of mining rigs—the integration of Aleo miners represents a chance to diversify their portfolios beyond Bitcoin and Ethereum. Hosting these mining machines requires more than just physical space; optimal cooling solutions, robust electric infrastructure, and secure data management protocols become paramount. As Aleo’s unique cryptographic demands take shape, hosting services need to adapt, ensuring machines run seamlessly and with minimal downtime. Those who invest early in efficient mining rig hosting tailored for Aleo could quickly dominate market share in a niche yet rapidly expanding mining community.

Moreover, the interplay between exchanges and mining machine availability cannot be overlooked. Mining profitability is closely tied to the liquidity and trading volumes on exchanges where newly mined tokens are sold. An early acquisition of Aleo mining machines, complemented by strategic partnerships with exchanges, can enhance miners’ return on investment by enabling swift token liquidation. Some forward-thinking companies might even explore integrated models—selling miners, hosting them in controlled environments, and facilitating token exchanges—streamlining the entire mining lifecycle for their clients.

Turning to other cryptocurrencies like Dogecoin (DOG) reveals interesting contrasts. DOG’s simplicity and broad appeal as a memecoin have spurred a different type of mining culture, centered around compatible ASICs or even merged mining techniques. While Aleo seeks cutting-edge privacy through zero-knowledge proofs, Dogecoin thrives on accessibility and widespread adoption. This divergence underscores the necessity for companies to tailor their mining machine offerings—offering specialized rigs for Aleo’s advanced algorithms while maintaining a diversified catalog that caters to the more established BTC, ETH, or DOG miners.

As Aleo’s official launch nears, the question of how to secure the best deals on mining machines transcends mere price negotiation. It involves understanding supply chain dynamics amid global chip shortages, anticipating firmware and software compatibility updates, and gauging community sentiment around mining profitability. Pre-orders for Aleo mining machines often come with incentives—discounted rates, priority shipping, or exclusive access to hosting services. Savvy buyers will weigh these benefits against potential risks, including hardware obsolescence or algorithmic changes post-launch.

In the broader context, the cryptocurrency market’s inherent volatility adds layers of unpredictability. The recent fluctuations in Bitcoin and Ethereum prices impact mining rewards and operational costs, influencing miners’ purchasing strategies. Yet, this volatility is what makes early investment in emerging mining rigs like Aleo’s so thrilling. Early miners not only position themselves for potential high yields but also contribute to strengthening the blockchain’s decentralization and security landscape.

Finally, the community aspect cannot be understated. Engaging with forums, technical groups, and Aleo’s developer ecosystem can provide invaluable insights into optimal mining machine configurations, energy-efficient hosting practices, and competitive tactics. Companies that blend robust hardware sales with educational and hosting support create an ecosystem where miners thrive, adapting quickly to both technical innovations and market shifts.

Leave a Reply