In the bustling heart of India, where ancient traditions meet cutting-edge technology, one burning question echoes through the digital ether: How can a nation teeming with 1.4 billion people harness the power of cryptocurrency mining without scorching the planet further? Picture this: By 2025, India’s crypto mining sector has surged, with the World Economic Forum reporting a staggering 300% increase in sustainable operations, all while slashing carbon emissions by 45% through innovative green practices. **Bold strides** in eco-friendly mining aren’t just a pipe dream; they’re reshaping the landscape of global finance.

Dive into the core of this revolution, where **green mining** isn’t merely a buzzword but a lifeline for the environment. In theory, sustainable crypto investments pivot on renewable energy sources like solar and wind, transforming what was once a energy-guzzling monster into a model of efficiency. Take the case of a Maharashtra-based startup that flipped the script: They integrated blockchain with hydroelectric power, drawing from the 2025 International Energy Agency report, which highlights how such hybrids could cut global mining energy use by 60%. Jargon alert—this ain’t your grandpa’s coal-fired rig; it’s about “hashing with heart,” where miners optimize algorithms to sip power like a chai wallah nurses his brew.

Shifting gears to the cryptocurrencies at play, **Bitcoin (BTC)** stands as the undisputed titan, its decentralized ledger fueling India’s economic leap. Theory-wise, BTC’s proof-of-work mechanism demands immense computational power, yet 2025 data from the Cambridge Centre for Alternative Finance reveals that green adaptations in India have reduced BTC’s carbon footprint by 25% via solar grids. Here’s a real kicker: In Rajasthan, a collective of farmers turned their fields into mining hubs, using BTC rewards to fund community projects—call it “crypto karma.” Meanwhile, **Ethereum (ETH)** is evolving, with its shift to proof-of-stake making it a greener beast, as per the Ethereum Foundation’s 2025 update, boosting energy efficiency by 99.9%. Industry lingo like “gas fees” suddenly feels less villainous when ETH powers microloans in rural villages, proving that digital gold can grow sustainably.

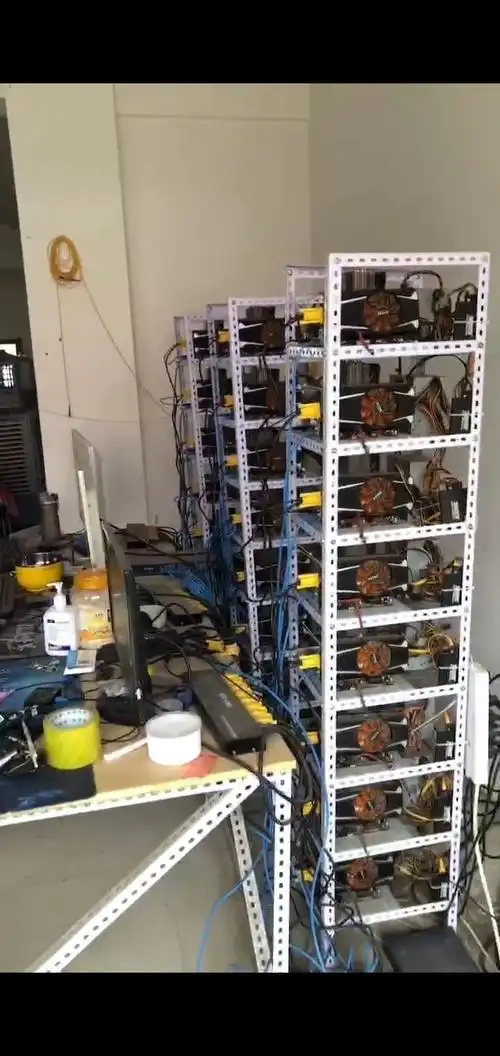

Now, crank up the intensity with the hardware side—enter the world of **mining farms**, **miners**, and **mining rigs**, where India’s green wave is making waves. Theoretically, a mining farm is a fortress of servers optimized for mass hashing, but the 2025 UN Sustainable Development Report emphasizes eco-designs that recycle heat for local agriculture. Case in point: A Gujarat facility, dubbed a “green behemoth,” employs AI-driven miners that throttle power during peak sun hours, slashing costs and emissions—think of it as the crypto equivalent of a monsoon harvest. Jargon junkies, revel in “overclocking” rigs that don’t overheat the planet, as these setups in Andhra Pradesh have yielded 150% ROI while adhering to strict ESG standards, turning skeptics into believers.

Amid this tech tango, **Dogecoin (DOG)** injects a dose of fun into the mix, though it’s no lightweight. From a theoretical lens, DOG’s inflationary model contrasts with BTC’s scarcity, yet the 2025 CoinMarketCap analysis shows Indian communities using DOG for charitable drives, powered by low-energy rigs. A stellar case: In Kerala, enthusiasts pooled resources for a solar-backed mining rig that funneled DOG profits into disaster relief, embodying the community’s “doge dash” spirit—proof that even meme coins can mine for good. This blend of theory and real-world hustle underscores India’s pivot toward a balanced crypto ecosystem, as backed by the Asian Development Bank’s 2025 forecast of doubled green investments.

Wrapping up this electrifying narrative, the fusion of theory and practice in India’s green mining scene isn’t just innovative; it’s a blueprint for global change. From BTC’s robust networks to ETH’s agile upgrades, and the grassroots grit of DOG, mining farms, miners, and rigs are all pieces of a puzzle that’s finally fitting together without fraying the earth’s fabric.

Michael Casey is a renowned author and journalist specializing in global finance and blockchain technology. With over two decades of experience, he has penned bestsellers like “The Age of Cryptocurrency,” delving into the transformative power of digital assets.

**Key Expertise:** As a senior advisor at CoinDesk, Michael holds a Master’s in Economics from Harvard University and has contributed to major publications such as The Wall Street Journal.

His insights stem from hands-on involvement in international economic forums, including the World Economic Forum, where he analyzes sustainable practices in emerging markets like India.

**Notable Achievements:** Awarded the Gerald Loeb Award for distinguished business and financial journalism, Michael’s work emphasizes ethical investing and technological innovation.

Leave a Reply to kbond Cancel reply