The relentless hum of a Bitcoin mining machine, a constant drone in the background, is the sound of the digital gold rush. These specialized computers, far removed from the sleek laptops and smartphones we use daily, are the workhorses of the blockchain, tirelessly solving complex cryptographic puzzles to validate transactions and earn newly minted Bitcoin. But the landscape of Bitcoin mining hardware is a constantly shifting one, with new models emerging promising greater efficiency and profitability. Navigating this terrain requires a keen understanding of the strengths and weaknesses of various popular mining machines, weighing their upfront costs against their long-term performance and power consumption.

The allure of Bitcoin mining lies in its potential for passive income. Imagine a machine, diligently working around the clock, generating digital wealth while you sleep. However, the reality is far more nuanced. The difficulty of Bitcoin mining, a measure of how challenging it is to solve the cryptographic puzzles, adjusts dynamically to maintain a consistent rate of block creation. As more miners join the network, the difficulty increases, meaning individual machines must work harder to earn the same amount of Bitcoin. This constant race against the increasing difficulty necessitates a continuous evaluation of mining machine efficiency.

Among the titans of the mining world, Bitmain’s Antminer series consistently ranks as a popular choice. These machines, known for their robust performance and relative reliability, are often the go-to option for both individual miners and large-scale mining farms. However, their price point can be a significant barrier to entry, particularly for newcomers to the Bitcoin mining scene. Furthermore, power consumption is a critical factor. High-powered mining machines can generate substantial electricity bills, potentially eroding profitability, especially in regions with high energy costs. The delicate balance between hash rate (the speed at which a machine can perform calculations) and power consumption is a crucial consideration.

Other manufacturers, such as MicroBT with their Whatsminer series, offer competitive alternatives to the Antminer. These machines often boast comparable hash rates and power efficiency, sometimes even surpassing Bitmain’s offerings in specific areas. The competition between these manufacturers drives innovation and ultimately benefits the mining community by providing a wider range of options and pushing the boundaries of mining technology. Selecting the right mining machine requires a thorough comparison of specifications, real-world performance data, and user reviews.

Beyond the hardware itself, the location of your mining operation plays a pivotal role in its profitability. Mining machine hosting services have emerged as a popular solution for those who lack the space, infrastructure, or technical expertise to manage their own mining operations. These hosting providers offer secure facilities, reliable power supplies, and expert maintenance, allowing miners to focus on maximizing their earnings without the headaches of managing the physical hardware. However, hosting fees can eat into profits, so it’s essential to carefully evaluate the terms and conditions of different hosting providers.

The landscape extends beyond Bitcoin (BTC). While BTC mining dominates the conversation, alternative cryptocurrencies, such as Ethereum (ETH – although now transitioned to Proof-of-Stake), Dogecoin (DOGE), and others, have their own mining ecosystems. Different algorithms require different types of hardware, and the profitability of mining these alternative coins can fluctuate wildly based on market demand and network difficulty. Some miners choose to diversify their operations by mining multiple cryptocurrencies, hedging their bets against the volatility of the crypto market. This diversification strategy can reduce risk but also requires a deeper understanding of the various mining algorithms and hardware requirements.

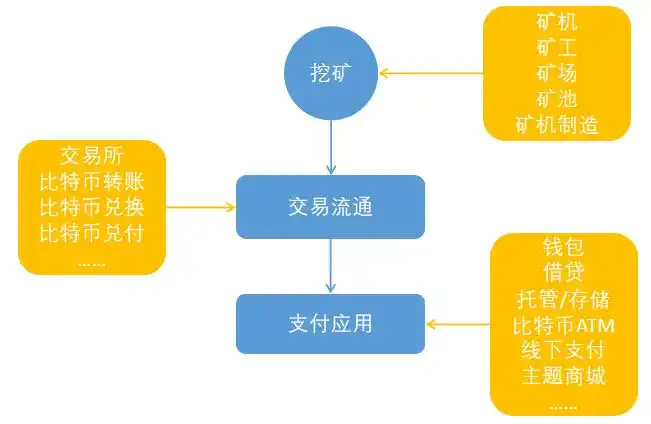

Exchanges play a crucial role in the Bitcoin mining ecosystem, providing a platform for miners to convert their earned Bitcoin into fiat currency or other cryptocurrencies. The fees charged by exchanges can impact profitability, so it’s essential to choose an exchange with competitive rates and a reputation for security. Furthermore, the speed and reliability of transaction processing are critical, as miners need to be able to quickly and efficiently convert their earnings into usable currency. The integration of exchanges into the mining workflow is often seamless, allowing miners to automate the process of converting their earnings and managing their cryptocurrency holdings.

The future of Bitcoin mining is likely to be shaped by several factors, including advancements in hardware technology, fluctuations in energy costs, and regulatory changes. As the difficulty of Bitcoin mining continues to increase, the pressure to improve efficiency will only intensify. We may see the emergence of new mining algorithms, more energy-efficient hardware designs, and innovative approaches to cooling and power management. The ongoing evolution of Bitcoin mining is a testament to the ingenuity and adaptability of the cryptocurrency community.

Furthermore, the environmental impact of Bitcoin mining is an increasingly important concern. The high energy consumption of mining operations has drawn criticism from environmental groups and policymakers. As a result, there is growing pressure on miners to adopt more sustainable practices, such as using renewable energy sources and improving the efficiency of their hardware. The transition to more environmentally friendly mining practices is essential for the long-term sustainability of the Bitcoin network.

Leave a Reply to Yeti Cancel reply